Why Illinois Has One of the Most Unstable Housing Markets

Why Illinois Has One of the Most Unstable Housing Markets

The Unstable State of the Illinois Housing Market

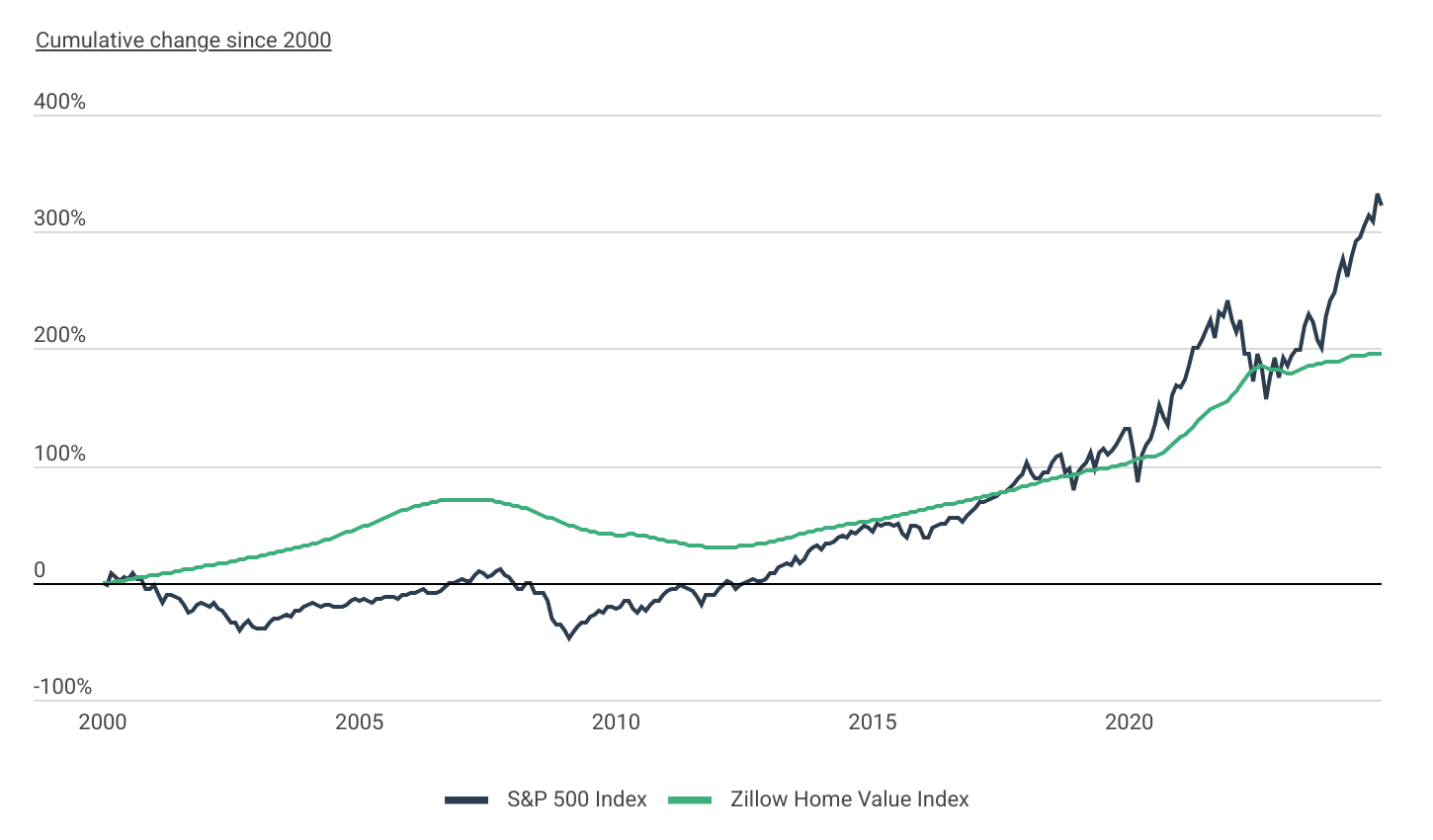

Illinois has gained attention as having the 5th least stable housing market in the nation, a status that raises concerns for both residents and potential homebuyers. The Illinois housing market is characterized by its volatility, with a historical probability of 38.5% for a 5% price drop since 2000. This level of instability makes understanding market dynamics crucial for anyone involved in property transactions within the state.

A stable housing market is vital as it provides predictability and security for homeowners and investors alike. In contrast, an unstable housing market can lead to significant financial risks, including sudden changes in property values that affect wealth accumulation and investment returns.

The key takeaway from recent analyses is Illinois’s precarious position among U.S. states concerning housing market stability. For individuals navigating this complex landscape, awareness and strategic planning become essential tools to mitigate potential risks associated with such fluctuations. With economic conditions and demographic shifts continuing to impact housing trends, vigilance remains necessary to adapt to these evolving challenges.

Understanding Housing Market Stability

Understanding what constitutes a stable housing market is crucial for both policymakers and investors. A stable market is characterized by predictable real estate trends, where home prices rise at a steady pace in line with inflation and economic growth. This stability allows both buyers and sellers to make informed decisions without the fear of sudden value fluctuations.

Several factors contribute to housing market stability:

- Economic Conditions: A strong local economy supports job growth, which in turn stimulates housing demand. Economic stability reduces the risk of foreclosures and maintains buyer confidence.

- Local Demand and Supply Dynamics: A balanced relationship between housing supply and demand ensures that neither buyers nor sellers have disproportionate influence over the market. Overbuilding or undersupply can lead to volatility.

- Interest Rates: Stable interest rates encourage consistent borrowing patterns, making mortgages more predictable for homeowners.

Comparing Illinois with other states highlights the disparities in market stability across the nation. States like South Dakota and Oklahoma enjoy stable markets due to their slow but steady economic growth, which prevents dramatic price swings. These states have not experienced a greater than 5% price drop in decades, demonstrating resilience against economic downturns.

On the other hand, states like Nevada and Florida are known for their volatile markets. Rapid population growth combined with speculative investment often leads to significant price fluctuations, as seen during the 2008 financial crisis.

Analyzing these different environments provides valuable insights for Illinois. By understanding how economic factors, supply-demand balance, and local policies affect market dynamics elsewhere, Illinois can explore strategies to mitigate its own housing instability challenges. This knowledge could guide future development decisions aimed at fostering a more predictable real estate landscape across the state.

Current State of the Illinois Housing Market

The Illinois housing market is experiencing significant changes, with property values increasing over the years. As of now, the median home price in Illinois is $264,399, which is a 112% increase since 2000. This growth indicates that there are different factors at play in various parts of the state’s housing market.

Key Insights:

- Median Home Price: Currently, the median home price is $264,399. This shows both growth and challenges for prospective buyers who may find it difficult to afford homes.

- Increase in Property Values: Since 2000, property values have risen by 112%. While this indicates a substantial increase, it also raises concerns about affordability for many residents.

These trends are closely connected to the overall economic conditions in Illinois. The state’s economy has faced challenges such as fluctuating job markets and changes in population demographics. Economic factors have a significant impact on real estate trends, affecting both supply and demand in urban and rural areas.

The rise in property values could suggest that the market is appreciating. However, it also highlights issues related to housing affordability, particularly in cities like Chicago where prices have gone up significantly. This increase in prices is not only due to inflation but also because of high demand caused by limited housing options and shifting demographic needs.

To understand the current state of the Illinois housing market, we need to consider these economic influences and how they interact with real estate trends. This understanding will help us assess the stability of the market in the future and its potential effects on current residents and new buyers entering the housing sector.

Factors Contributing to Instability in Illinois

Volatility Factors Impacting the Illinois Housing Market

The unstable nature of Illinois’s housing market is deeply intertwined with various local economic conditions. Job growth and population changes serve as significant contributors to this instability. Illinois has experienced sluggish job growth relative to other states, which can dampen housing demand. This is particularly evident in urban areas like Chicago, where economic opportunities often dictate housing market dynamics. Population decline also plays a role; as residents move elsewhere for better job prospects, housing demand decreases, causing fluctuations in market stability.

External Influences on Market Volatility

Investor-driven demand and construction trends further exacerbate the volatility of the Illinois housing market. Real estate investors often target markets perceived as lucrative, sometimes artificially inflating prices and disrupting local market stability. This speculative activity can lead to rapid price increases followed by sharp declines, contributing to Illinois ranking as the fifth least stable housing market in the nation.

Construction waves also impact market dynamics. While new developments are essential for addressing housing shortages, the timing and type of construction can significantly affect market conditions. For instance, an influx of high-end developments may not align with local demand for affordable housing, creating imbalances that contribute to volatility. The resulting mismatch between available housing and what residents can afford leads to further instability.

These factors collectively paint a complex picture of Illinois’s housing landscape, where both internal economic elements and external pressures shape a volatile environment that challenges stability.

Comparative Analysis with Other States’ Markets

Examining housing market stability across the United States reveals stark contrasts. States like South Dakota and Oklahoma demonstrate a remarkable level of stability, having experienced no greater than a 5% price drop in recent years. This resilience is often attributed to consistent economic conditions, manageable population growth, and a balance between housing demand and supply. These states maintain a steady influx of job opportunities that align with housing developments, ensuring that the market remains stable without the risk of overvaluation.

On the other hand, states such as Nevada and Florida are synonymous with volatility. Their real estate markets have been marked by rapid growth cycles followed by significant downturns, primarily due to speculative investments and overbuilding. Nevada’s market is particularly known for its boom-and-bust patterns, influenced by its reliance on tourism and gambling industries which are susceptible to economic shifts. Florida faces similar challenges, where rapid population growth spurred excessive construction, leading to an oversupply.

Lessons for Illinois

Illinois can draw valuable lessons from these varying market dynamics:

- Balanced Growth: By observing South Dakota and Oklahoma’s balanced approach to development, Illinois could work towards aligning housing starts with actual demand to avoid oversaturation.

- Economic Diversification: Reducing dependency on a few sectors can mitigate risks associated with downturns. Encouraging diverse industries ensures more stable employment levels that support a steady real estate market.

- Regulatory Frameworks: Implementing policies that promote affordable housing while controlling speculative investments can prevent extreme price fluctuations seen in markets like Nevada and Florida.

Analyzing these contrasting examples provides insights into strategies Illinois might adopt to enhance its own housing market stability. By focusing on sustainable development practices and fostering economic diversity, Illinois has the potential to transform its volatile real estate landscape into one marked by resilience and predictability.

Long-term Implications for Homebuyers in an Unstable Market

Navigating the housing market in Illinois presents significant challenges for potential homebuyers. The state’s instability poses several risks, primarily the potential loss of property value over time. As housing prices fluctuate, buyers may find themselves owning homes worth less than their purchase price, resulting in negative equity.

Investment Considerations:

- Market Timing: Understanding when to enter or exit the market is crucial. Monitoring economic indicators such as employment rates and local development projects can provide insights into market trends.

- Location Matters: Certain areas within Illinois may experience more stability than others. Urban centers like Chicago might face higher volatility compared to suburban or rural locations. Buyers should conduct thorough research on neighborhood trends and historical price changes.

- Diversification of Investment: Instead of putting all financial resources into a single home purchase, consider diversifying investments across different asset classes to mitigate risks associated with market instability.

- Long-term Strategy: Given potential fluctuations, a long-term holding strategy might be beneficial. This approach allows homeowners to weather short-term volatility and capitalize on eventual market recovery.

Advice for Homebuyers:

- Seek professional advice from real estate experts who understand the nuances of the Illinois market.

- Stay informed about legislative changes impacting housing policies and tax incentives that could affect homeownership costs.

- It’s also beneficial for buyers to familiarize themselves with housing trends that can provide valuable insights into future market behaviors.

By remaining vigilant and strategic, homebuyers can better navigate the complexities of one of the most unstable housing markets in the United States, making more informed decisions that align with their financial goals and risk tolerance.

Future Predictions for the Illinois Housing Market Stability

As Illinois grapples with its recognition as having the 5th least stable housing market in the nation, future trends and forecasts present a mixed picture. Economic indicators and housing data suggest that the state may continue to face instability, influenced by several persistent challenges.

1. Economic Outlook

Illinois’s economic performance remains pivotal. With job growth fluctuating and population changes ongoing, these elements will significantly impact housing demand and price stability. A robust economic upturn could potentially stabilize prices, though current projections remain cautious.

2. Housing Supply and Demand

The supply-demand imbalance persists as a critical factor. Limited construction of affordable housing juxtaposed with increasing demand exacerbates volatility. This dynamic is expected to continue unless there is a substantial policy shift or investment in housing development.

3. Investor Influence

Investor-driven demand has been a double-edged sword, inflating prices while contributing to market volatility. Future forecasts suggest this trend might persist, especially in urban centers like Chicago, unless regulatory measures are introduced.

Illinois’s housing market trajectory hinges on addressing these factors effectively. As stakeholders navigate this uncertain landscape, understanding these future predictions will be crucial for informed decision-making in an inherently unstable market environment.

Conclusion: Understanding the Unstable Illinois Housing Market

Illinois has the 5th least stable housing market in the nation, which means that both residents and potential buyers are facing a situation that is unpredictable. This instability requires them to be more careful and make informed choices.

- Residents need to stay alert and realize that changes in home values can affect their property equity and financial plans.

- Potential buyers should carefully consider when to buy and how to invest, balancing possible risks with long-term advantages.

It’s important to be aware of the economic, demographic, and external factors that contribute to this instability. Being flexible and thinking ahead strategically are key in dealing with these uncertain times. To protect investments and ensure stable housing, it’s not enough to just know what’s happening now; we also need to predict future changes.

FAQs (Frequently Asked Questions)

What is the current state of the Illinois housing market?

The Illinois housing market is currently ranked as the 5th least stable in the nation, with a 38.5% chance of experiencing a 5% price drop since 2000. The median home price is approximately $264,399, reflecting a 112% increase in property values since 2000.

What factors contribute to the instability of the Illinois housing market?

Factors contributing to the instability of the Illinois housing market include local economic conditions such as job growth and population changes, as well as external influences like investor-driven demand and fluctuations in construction activity.

How does Illinois compare to other states regarding housing market stability?

Illinois’s housing market is less stable compared to states like South Dakota and Oklahoma, which have shown no significant price drops. In contrast, states like Nevada and Florida exhibit volatility due to rapid growth, highlighting the varying levels of stability across the nation.

What risks do homebuyers face in an unstable housing market like Illinois?

Homebuyers in an unstable market like Illinois face risks such as potential loss of property value over time. It is crucial for buyers to consider timing and investment strategies based on current trends to mitigate these risks.

What are the future predictions for the Illinois housing market?

Future predictions for the Illinois housing market indicate continued instability based on current data trends and economic outlooks. Buyers should stay informed about these trends to make educated decisions.

What should prospective homebuyers keep in mind when navigating the Illinois housing market?

Prospective homebuyers should approach the Illinois housing market with caution due to its instability. It’s essential to conduct thorough research, understand current trends, and consider long-term implications before making any purchasing decisions.

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua

12 Comments

Leave A Comment

You must be logged in to post a comment.

[…] it’s important to understand that Illinois has one of the most unstable housing markets, which makes it essential to make informed decisions when remodeling your home. In this article, […]

[…] be higher compared to smaller towns or rural regions. This is further complicated by the fact that Illinois has one of the most unstable housing markets, which can impact remodeling […]

[…] both your home’s value and your quality of life in Illinois. Given the current situation where Illinois has one of the most unstable housing markets, investing in a sunroom addition could be a strategic move to increase your home’s value […]

[…] more detailed insights into Illinois’ housing market, or to explore our renovation services that cater specifically to these challenges, feel free to […]

[…] it’s important to understand that Illinois has one of the most unstable housing markets, which makes choosing the right professionals even more crucial. The remodeling process involves […]

[…] worth noting that Illinois has one of the most unstable housing markets, which further emphasizes the need for homeowners to be proactive in weatherproofing their […]

[…] the unique challenges of the local housing market, which is known for its instability as discussed here. Each project undertaken should reflect not only the needs of the family but also align with […]

[…] saving energy; they also play a crucial role in stabilizing the housing market. For instance, the Illinois housing market has been known for its instability, but strategic renovations can help alleviate some of these […]

[…] living space. This is especially crucial in a region like Central Illinois, which is known for its unstable housing market. In such a volatile market, having a smart home automation system that can adapt to changing needs […]

[…] it easier to achieve an energy-efficient home remodel. However, it’s important to note that Illinois has one of the most unstable housing markets, which can affect your remodeling plans. Hence, understanding these market dynamics is crucial when […]

[…] it’s essential to note that Illinois faces one of the most unstable housing markets, which further emphasizes the importance of innovative solutions like adaptive reuse in meeting […]

[…] upcoming renovation project. However, it’s crucial to understand the potential impact of the instability in the housing market on your remodeling […]